“Is the mortgage interest on my RV tax deductible?” I get this question a lot from digital nomads, full-time RVers, and full-time boaters looking for ways to save money on their taxes.

This is a pretty easy question to solve. Below, we walk through how you can determine if you can write-off your mortgage interest paid on your RV, travel trailer, or boat on your taxes and how to do it.

Other tax deductions to know if you qualify for:

Disclaimer: The information and materials we share are intended for reference only. As the information is designed solely to provide guidance, it is not intended to be a substitute for someone seeking personalized professional advice based on specific factual situations. Therefore, we strongly encourage you to seek the advice of a professional to help you with your specific needs.

Watch My Explanation on YouTube:

Can You Deduct or Write-Off Your Mortgage Interest from your RV, Travel Trailer, or Boat on Your Taxes?

Yes, if your rig meets these criteria:

There’s two criteria your RV, travel trailer, boat, or house need to meet to be able to write off your mortgage interest on your taxes.

First, is your RV, boat, travel trailer, or house a primary or secondary residence you have? If it is, then you’re on your way to being able to deduct the mortgage interest you’ve paid.

If you have more than two “secondary” residences, you may be able to make this deduction, but it is out of the scope of this post. Feel free to contact me here and we can talk through your situation.

Second, is your RV, boat, or travel trailer considered a home? The IRS defines a “home” as anywhere you have these three things:

A sleeping area

A cooking area

A toilet

If your RV, boat, travel trailer, or house meet all of the criteria above, yes, you can add the mortgage interest you’ve paid on your taxes as an itemized deduction.

How do you make the deduction on your tax return?

Deducting your mortgage interest is considered an itemized deduction on your Form Schedule A.

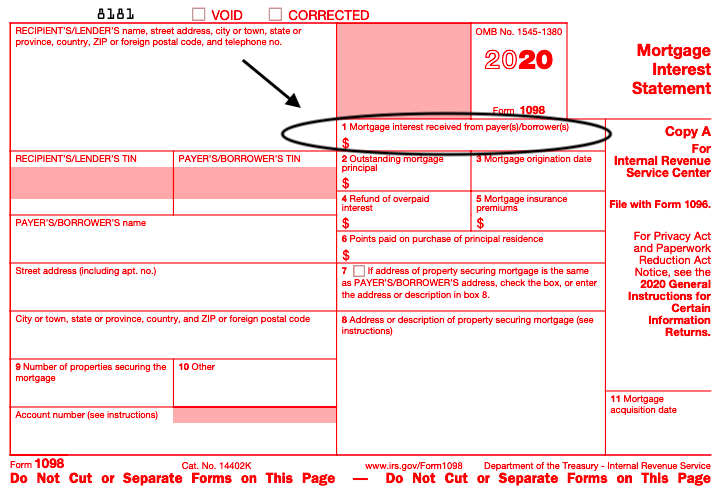

To make this deduction, you’ll first receive a Form 1098 from your loan company or mortgage company by January 31 each year. Form 1098 states the amount of mortgage interest you paid for the year on Line 1. You’ll take the mortgage interest paid that’s stated on your Form 1098 and plug that amount into your Schedule A on Line 8a.

If you did not receive Form 1098 from your loan company, then you’ll insert the amount of mortgage interest you’ve paid on Schedule A, Line 8b as well as the bank’s name, address, and Employer ID Number.

For reference, here’s what Schedule A and Form 1098 look like.

Schedule A:

Form 1098:

Save this for later!

Doing your taxes later? Download this information on our worksheet to remember how to make this deduction later when you’re doing your tax return.

Have a Question?

Heyo! I’m Adam Nubern, a digital nomad CPA. I hope this information is helpful for you. If you have any questions, please snag a time here and we can chat through your questions together.